-

Getting The When Does Car Insurance Go Down? – The Hartford To Work

Many of all, it can create a person's responsibility auto insurance coverage prices to increase – cheap insurance. Obtaining economical vehicle insurance under 25 is feasible if they comply with several of these helpful pointers to discover the best auto insurance coverage for males under 25. car. Find out more to discover what to do and also what not to do when a 25 and under male is searching for the most affordable vehicle insurance policy premium for a 21-year-old man.

Just how much is car insurance for men under 25? What are the typical vehicle insurance costs for a 23-year-old man? We partnered with Quadrant to reveal you the typical rates for auto insurance for 25-year-old men. For chauffeurs under 25, car insurance coverage can be costly – cars. Have a look at the table below.

low cost cheaper cars cheap car insurance insurance

low cost cheaper cars cheap car insurance insuranceUnless you have several speeding tickets, Drunk drivings, several vehicle mishaps, and also claims, you may be shocked that some of the most popular firms have the most affordable vehicle insurance coverage prices for university pupils as well as men under 25. Allstate has actually been around for a long period of time as well as offers multiple resources for young chauffeurs.

vehicle insurance accident credit cheapest

As one of one of the most enjoyable insurer with its "Flo" personality, Progressive is rated high for being versatile. liability. They desire every person to be their consumer as well as have fantastic customer contentment scores. Actually, Progressive is thought about to be among the best-priced providers. GEICO is yet an additional enjoyable car insurer.

If you're male and under 25, they may be your ideal alternative for an insurance coverage plan. Contrast Quotes From Top Companies and also Conserve Protected with SHA-256 File encryption Youthful chauffeurs are unskilled as well as conveniently sidetracked.

How What Age Does Car Insurance Rates Go Down? (2022) can Save You Time, Stress, and Money.

As males undergo these discovering periods, they mature as well as are less prone to poor judgment while running a motor lorry (insurance). As a result, automobile insurance rates decrease after the age of 25. The very best suggestions that can be created young male chauffeurs to obtain the least expensive insurance policy premiums for 25-year-old men is to practice good sense behind the wheel.

Obtaining a vehicle driver's certificate is an initiation rite for youngsters almost everywhere – insure. Regretfully, a lot of them waste this chance by being careless behind the wheel. cheap. Absolutely nothing good will ever before come from inadequate driving habits. Beginning excellent driving habits early is an easy way to ensure you become a risk-free chauffeur.

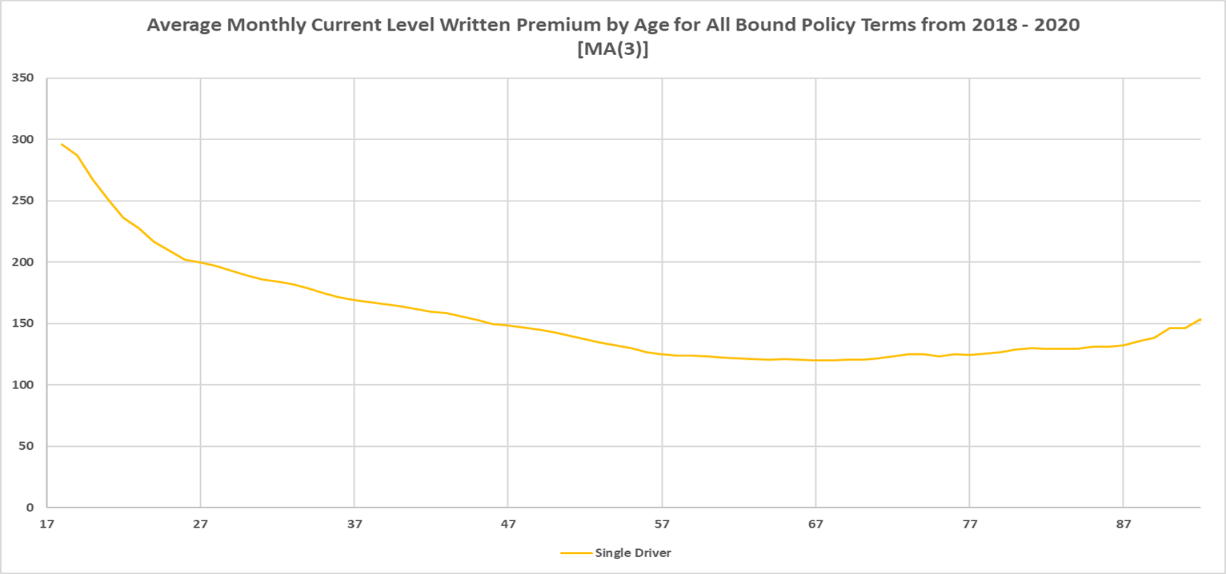

At age 75, the average premium starts to trend upward. From the ages of 21 to 25, female vehicle drivers' rates progressively visit nearly 25%, according to research studies. cheaper cars. Except for Iowa, every state in the nation generally has. This is since females are viewed as being much more practical motorists.

Because females drive less costly vehicles than males on average, the cars they drive present much less economic liability to an insurance company. Twice as many men have speeding tickets and also DUIs on their documents than ladies. A research study by the Insurance Institute for Highway Safety (IIHS) discovered that two times as numerous men than ladies die in car accidents every year.

prices prices cheapest accident

prices prices cheapest accidentAs for driving data go, they are out the side of males. That is something insurance companies bear in mind, and they will adjust their costs and plans as necessary. With Look at this website this in mind, the most effective point for a young male chauffeur to do is to set an example (prices).

The Greatest Guide To Are Average Car Insurance Rates Affected By Age?

If you have actually been accident-free for a lengthy period of time, don't get contented. As well as even though you can not revise your driving history, having an accident on your document can be a vital reminder to constantly drive with care and also care.

, particularly solitary men.

cheaper cars auto insurance liability insurance company

cheaper cars auto insurance liability insurance companyMany auto insurance companies give discount rates to trainee chauffeurs that keep great grades. vehicle insurance. Your insurance coverage representative can share the pros and disadvantages of these alternatives.

In general, it does not harm and also may very well assist. These use based vehicle insurance coverage programs record just how you drive as well as the miles you drive., occasionally called packing, can save you cash (insurance).

When Does Car Insurance Go Down In Price? – The Balance for Beginners

vehicle insurance automobile vehicle insurance vehicle insurance

vehicle insurance automobile vehicle insurance vehicle insuranceWondering just how a lot the expense of automobile insurance will be for that lovely new car you've been fantasizing concerning? You're not the only one. And landing on that specific number can be challenging for a number of reasons due to the fact that insurance prices can vary by vehicle type and also the age of the vehicle.

However other factors like your personal financial background and your family's driving documents can all influence the price of your premium also. To better comprehend what elements are in play, let's take a look at what enters into calculating the cost of vehicle insurance policy as well as dig deep right into the factors that persuade your insurance coverage costs (insurance).

They'll also ask you regarding your favored protection limitations, which can change the cost of your car insurance policy. cars.

Usually, this will imply you'll be altering your policy, whether you're including your new spouse or eliminating your ex. You may be able to conserve money on automobile insurance policy with a great debt ranking.

If you've not had a significant crash in five years, this can benefit your vehicle premium. Likewise, when no building damage or liability cases have been made versus you in the recent past, you stand to get a much better price. The cost of your auto as well as the year it was produced will certainly be utilized to assist create your insurance policy rates – insurance company.

At What Age Does Car Insurance Go Down? – Clovered Fundamentals Explained

The location as well as postal code where your car is signed up will certainly have an influence on the quantity you spend for insurance coverage. Safe communities with low criminal activity rates are usually connected to lower insurance coverage prices (auto insurance). If you're able to bundle various other policies with your auto coverage, you can minimize your costs.

With American Household Insurance, you may be able to save big. Contact your representative to get more information concerning packing. You'll likely be inquired about the way you mean to utilize your vehicle when you apply for vehicle insurance. You'll be asked about the range you'll be driving to and from job every day as well as concerning your predicted annual gas mileage.

-

Do I Need Car Insurance Before I Buy A Car? – Policygenius Can Be Fun For Everyone

Your citation could be rejected if you can provide the court with proof of legitimate insurance policy for the day of the citation within 30 days. Driving without automobile insurance in all is a lot more serious, and the penalties are a lot more severe. Along with the legal effects, you can additionally anticipate your automobile insurance policy premium to increase.

If you obtain right into a mishap while driving without insurance coverage in Maryland, you will be cited and also all the penalties for driving without insurance will apply, despite that is at fault. cheap car insurance. Driving uninsured can make it challenging to be made up View website for damages if you are not at fault and also can have long-lasting and life-altering effects if you are at fault – insurance affordable.

Along with the legal repercussions for driving without insurance policy, you might quickly be accountable for tens of hundreds of dollars or more in damage to your lorry, the other motorist's fixing as well as healthcare facility expenses, and your very own healthcare. vehicle. Both the other chauffeur and their insurance provider can sue you and also have future incomes as well as savings garnished to pay for problems – insurance company.

Also if the crash is not your fault, driving without insurance leaves you vulnerable to pricey hospital and also repair bills. Maryland is an at-fault state. vehicle. In at-fault states, the various other chauffeur is generally liable for damage to your cars and truck and any type of clinical treatment you may needassuming the various other chauffeur is discovered entirely at-fault.

Driving uninsured doesn't negate the other vehicle driver's fault entirely, yet you're likely going to be punished as well as not able to recoup everything you would be qualified to if you had insurance policy. Unless you're a freshly certified vehicle driver, having a background of driving without insurance policy or lapses in coverage is a risk to insurance companies.

USAA, State Farm, Nationwide, as well as Geico have a tendency to have the most affordable prices for vehicle drivers who desire to restore protection. It's not unlawful to drive another person's automobile if you do not have insurance, but non-owner cars and truck insurance can safeguard you if you don't have a car but still drive frequently.

The Ultimate Guide To New Car Insurance Grace Period – Thetruthaboutinsurance.com

prices insured car cheap auto insurance vans

prices insured car cheap auto insurance vansIn Maryland, motorists with just 2 speeding tickets pay an average of 27% even more on their annual automobile insurance costs – cheapest auto insurance. Depending on your driving record and also the seriousness of your offenses, you might pay a lot more. Still, also though rates may be greater, at the very least you can drive lawfully as well as prevent even more charges.

In Maryland, you can locate standard obligation car insurance coverage for around $1,077 each year if you have a clean driving record. vehicle insurance. The effects of driving without insurance coverage are inevitably much more expensive than purchasing minimum vehicle insurance protection. Regardless of what your special needs are, the finest method to get accurate quotes as well as the most effective costs is to contrast store.

Few events in life are as exciting as purchasing and also driving a new lorry. cheaper auto insurance. But prior to authorizing on the populated line as well as taking the keys from the dealership, it's crucial to see to it that you have the appropriate insurance when acquiring a new car (affordable). After all, accidents can happen anywhere and also anytime– also as you are driving your brand-new trip off the lot.

But it won't cover you as soon as you purchase the lorry. You'll need to get your very own insurance for a brand-new cars and truck. As pointed out previously, even if your state sets a minimal amount for automobile insurance policy coverage does not indicate it's sufficient. Consider that responsibility insurance policy only spends for problems to the various other automobile (cheaper car).

affordable vans car insurance cheap insurance

affordable vans car insurance cheap insuranceIf you get right into a mishap with problems and injuries greater than the quantity of your coverage, the other event might sue you for the extra prices. If you own a home or various other properties, they can be at danger.

affordable car insurance trucks car insurance companies

affordable car insurance trucks car insurance companiesFurthermore, this coverage will certainly repay you and also your passengers for shed earnings. vehicle insurance. "Uninsured driver home damage protection pays for damages to your lorry brought on by a without insurance vehicle driver as well as additionally covers damage to various other personal effects, such as your residence or your fence, although this protection is not readily available in all states," Friedlander says.

Rumored Buzz on Insurance Grace Period After Buying A Used Car – Clearsurance

Your automobile might diminish in value much faster than you repay the lending, especially at the start of the finance period – cheaper car insurance. Accident and extensive insurance coverage just pay the present worth of your auto. Without void coverage, you may be left paying the rest of a loan on a vehicle you no longer very own." Rental insurance coverage on a car is optional, as well as many individuals don't believe to include it to their policy. "Yet if you were included in a mishap tomorrow, would you need a rental automobile to get to work? If so, you ought to think about bring rental coverage," Bromley suggests. suvs.

perks vehicle insurance affordable auto insurance accident

perks vehicle insurance affordable auto insurance accident business insurance auto insurance auto vans

business insurance auto insurance auto vansEven if you're intending on maintaining your existing automobile and adding a new one, altering auto insurance policy need to be straightforward. Best yet– you'll most likely be eligible for a multicar discount. All that's called for to include an additional vehicle to your insurance or change the old cars and truck with the new one is to call your insurance coverage carrier.

If you don't have the VIN yet, it's all. You can always include it once you have the tricks to the new automobile. Simply keep in mind that the even more information you can give your insurer, the a lot more exact the quote on the price difference in between the old as well as brand-new automobile insurance policy will certainly be. car.

The new vehicle you intend to get ought to be appropriately insured from the minute you initially drive it (insured car). As mentioned earlier, most insurers offer a poise period whereby they will automatically cover a brand-new automobile if you currently have a policy in area with one more vehicle.

-

7 Easy Facts About Average Car Insurance Costs In 2021 – Ramseysolutions.com Shown

Commonly, rates reduce by the time they get to age 25. auto. Age is not the only factor auto insurance policy companies utilize when setting vehicle drivers' insurance coverage prices. Also prior to reaching 25, young drivers can utilize other methods to minimize their prices, such as taking a driver training course and keeping excellent scholastic grades.

Normally, motorists in this category have actually not submitted an insurance claim or obtained a web traffic citation in the past three to five years, earning them the most affordable readily available rates. prices.: Criterion prices are greater than chosen rates as well as are used to chauffeurs that position moderate risk of suing. Usually, suppliers offer basic prices to individuals who drive family-style cars and have fairly good driving records.: Carriers bill higher, nonstandard prices to motorists they think about high risk.

If you maintain a great driving record up to age 25 but have bad credit scores, you may proceed to pay high insurance coverage premiums. Youthful chauffeurs who still cope with their parents and also do not possess their very own lorries can remain on a parent's auto insurance coverage policy as well as commonly pay lower premiums than if they get their very own insurance coverage.

: Several states permit insurance provider to use debt ratings when determining your insurance coverage price. Improving your credit history score can aid decrease your premiums in the future – car insurance. Some rate variables are a lot more difficult to balance out (cheap car insurance). If you live in a city with high auto-theft prices, you'll usually pay even more for car insurance policy.

Obtaining the least expensive price should not be your only goal; you also require to discover all the protections you need, supplied by a reliable as well as financially steady provider. For the best results, follow these standards: Make certain an insurance provider has a license to sell insurance in your state.

What Does Does Car Insurance https://objectstorage.sa-santiago-1.oraclecloud.com Go Down At 25? – Policy Advice Mean?

According to the National Organization of Insurance Commissioners, in 2019, United state car owners paid a standard of $1,096 per year, or $93. 33 per month, for car insurance coverage.

, which goes down when you get older.

cheapest trucks auto low cost

cheapest trucks auto low cost cheapest car insurance cheap insurance vehicle insurance cheap car

cheapest car insurance cheap insurance vehicle insurance cheap carAnd also while your credit rating, marriage condition, as well as education and learning level can assist insurance firms evaluate your level of risk, age is just one of the most significant aspects (cheaper car insurance). Adolescent drivers tend to create more accidents than older, extra experienced drivers, so insurance provider increase your rates because of the high threat variable. There are points you can do to assist reduce your rates.

According to the Insurance Institute for Highway Safety, 60 to 64 year olds have the most affordable rate of insurance claims they're fairly good drivers with a reduced crash price so their insurance coverage premiums are reduced. But cases prices start rising once again for 65 year olds, and fatal auto accident prices raise at 70, so those vehicle drivers generally will have greater costs.

Ask your insurance company concerning: Excellent pupil discounts, Great chauffeur discount rates, Vehicle security discount rates, Packing and policy revival discounts, Use based discounts, that track your driving with an app and also award savings for secure driving patterns Among the quickest means to save can be to purchase new automobile insurance coverage quotes from various business. vehicle.

How To Reduce Car Insurance Rates After The First Year Fundamentals Explained

Auto insurance coverage rates can also go up at revival, even if you're gone the entire plan term without any kind of crashes or insurance claims. risks.

low cost cheap insurance cheaper cars affordable car insurance

low cost cheap insurance cheaper cars affordable car insuranceWhen you got your motorist's certificate, you could've been surprised by just how much you had to pay your insurance companyand you didn't also have a mishap yet. You could not wait to transform 25 as well as have those high auto insurance policy rates ultimately come down. It's generally believed that vehicle insurance coverage premiums automatically drop for motorists at age 25.

cheaper auto insurance auto trucks affordable car insurance

cheaper auto insurance auto trucks affordable car insurance trucks dui insurance companies business insurance

trucks dui insurance companies business insuranceIt's more of a gradual decline when it comes to the correlation between car insurance policy rates and age. One point that does impact insurance plan rates for all insureds, however specifically at more youthful ages, is whether an insurance rating is factored right into the price.

Of training course, there are also points that will certainly enhance rates. If your driving history has web traffic infractions or accidents, if you're residing in a much more booming location, you had your credit history decrease, or you included drivers, you might see greater costs that have you paying much more for collision insurance coverage – car insurance.

This myth is unmasked. Inspect out what you may be able to conserve today – cheapest car insurance.

10 Simple Techniques For How To Reduce The Cost Of Car Insurance – Carinsurance.org

2022 I Drive Safely I Drive Securely Over 9 Million Satisfied Pupils We Develop Safer Chauffeurs

Some individuals do experience a decrease in the expense of their cars and truck insurance coverage rates after they turn 25 years old – cheap car insurance. Generally speaking, this is due to the fact that insurance firms see this landmark as indicative of a reduction in risk (cheapest). Yet this mostly relates to those that have actually never ever had a crash or claimed on their insurance.

As this, statistics program that more youthful drivers (between the age of 17 as well as 24 years of ages) are most likely to be hurt in a roadway crash than older vehicle drivers. vehicle insurance. So, as soon as you're 25 and also over, you'll statistically be much less likely to make a claim, which is why you may see a dip in your costs.

-

Not known Incorrect Statements About Best Car Insurance Companies 2021 – Kelley Blue Book

And also it doesn't compromise its service online reputation to achieve those low prices. Like most insurance firms, State Farm supplies roadside help and also rental auto expenses insurance coverage. vans. In case you do enter problem when traveling, these coverages can help you come back house and supplying replacement transport while your automobile remains in the shop.

EVEN MORE REGARDING HIGH-RISK INSURANCEBest Car Insurer for Youthful Drivers: Allstate, If you're including a young motorist to your plan, there are several top quality plan options offered (vehicle insurance). Both GEICO as well as Allstate place high in Cash, Nerd's scoring system for over 15 states for a policy with a young vehicle driver, yet we picked as our champion given that it uses a distant trainee discount rate and also GEICO doesn't.

Allstate is an exceptional option if you're allowing your teen drive your new auto. If you add new automobile replacement insurance coverage, you can change your automobile with an entirely new design after a crash, as long as the version is 2 years of ages or less (cheapest). As well as, if you include crash mercy, you won't need to fret about your insurance coverage rates boosting after your teen's initial accident (cheapest car).

auto insurance auto cheap insurance cheaper

auto insurance auto cheap insurance cheaperOf the insurers meeting this requirement, rates top. cheap. Leading Pick: Allstate (Ordinary Money, Nerd Rating: 3. 6/ 5)pros, This is an icon, Supplies new car substitute coverage, This is an icon, Has a low rate of consumer complaintscons, This is a symbol, Does not rate among the most inexpensive insurers, Allstate gives an equilibrium of price as well as good consumer solution while offering its chauffeurs the alternative to acquire new cars and truck replacement protection. low cost.

You can save with most of one of the most typical discount rates for being a risk-free vehicle driver, bundling house and car as well as anti-theft and having airbags and various other safety and security functions. prices. Ideal Vehicle Insurer for Distinct Insurance Coverages: Freedom Mutual, At the end of the day, lots of auto insurance provider offer insurance coverages needed by state regulation as well as bit much more – cheap car.

The Definitive Guide for Best Credit Cards For Car Rentals: Coverage And Benefits – Cnn

cheaper auto insurance car insurance insurers auto

cheaper auto insurance car insurance insurers auto cars insurance cheap insurance cheap auto insurance

cars insurance cheap insurance cheap auto insuranceFinest Car Insurer for Reduced Mileage Drivers: Metromile, Low gas mileage discount rates are reasonably uncommon and have a tendency to be fairly minor. If you barely drive, the very best method to save might be with a pay-per-mile insurance provider such as Metromile. Money, Nerd found that pay-per-mile insurance can be worth it if you only have a tendency to drive a couple of miles per day (low cost).

laws insurance money liability

Presently, it's the only insurance policy firm wholly specialized in pay-per-mile insurance policy. Nevertheless, the company does have a high price of client complaints. As traditional insurance firms get in the market for pay-per-mile insurance policy, it might make good sense to attempt several of their programs, such as Nationwide's Smart, Miles as well as Allstate's Milewise, which are broadening their schedule (vehicle insurance).

Incorporate that with terrific rates, and USAA is most likely to provide you the ideal value for your money. USAA does not provide several distinct alternatives insurance coverages, however it does have the most extensively relevant ones, such as roadside support, rental vehicle compensation as well as mishap forgiveness. cheap car insurance. It is likewise a good option if you benefit Uber or Lyft as it offers rideshare insurance coverage.

Contrast Automobile Insurance Policy Rates, Ensure you are obtaining the finest rate for your vehicle insurance coverage – affordable auto insurance. Actions to Find the Finest Vehicle Insurance Business, Locating the ideal automobile insurance for you will certainly depend on your top priorities (insurance).

Cash, Geek very advises beginning with our suggestions Learn more here for the top business in your state. 2Compare Genuine Quotes from Insurance Companies, When you've limited a checklist of business that have top quality service, you ought to go get a quote from that business – cheap car insurance. Our rankings for the most inexpensive companies are a terrific guide regarding which firms are most cost effective usually, however the least expensive for you might be various due to your distinct driver attributes. affordable.

The 5-Second Trick For Cheap Car Insurance – Affordable Auto Insurance – Liberty Mutual

Companies with an A+ or A++ from A.M. Best are the most safe and secure. The Ideal Company for You Has a Solid Client Service Track record, You can take lots of steps to figure out which insurance coverage business has the best customer solution for you.

If you wish to do your very own research study, J.D. low cost. Power launches an overall vehicle insurance satisfaction research study and an insurance claims satisfaction research every year. As well as if you wish to dig deep into the data, your state division of insurance website has public information on just how much consumers complain regarding insurer in your state.

Compare Quotes From the most effective Firms to Obtain Worth For Your Money, When you've limited the business with solid client service reputations, you should contrast quotes amongst them – auto insurance. Insurance coverage business utilize a range of aspects to compute your price. auto. Therefore, you can find that two companies have really similar customer support online reputations yet quote you at greatly different rates.

Others might merely not have the ability to afford it – cheaper auto insurance. In these situations, there might be state programs available to aid. State-Sponsored Automobile Insurance Coverage Programs for High-Risk Drivers, While some business provide individual automobile insurance plan to risky motorists, numerous prefer not to. Instead, states call for all insurance provider to join a program that pools these type of motorists.

Broaden ALLWho has the ideal vehicle insurance? The ideal car insurance policy company for you might depend on your motorist account and where you live. That has the best auto insurance in your state?

-

10 Easy Facts About 9 Ways Retirees Can Whittle Down Their Car Insurance Costs Described

List accredited vehicle drivers on your policy All licensed chauffeurs and all automobiles driven in your home are required to be detailed on your car insurance plan. Even if you as well as your partner drive different cars and trucks, for instance, you'll still have to detail them and also their automobile on your plan (insured car).

But let's state your roomie has a bad driving document, and you don't wish to obtain hit with a higher premium as a result of them. No concerns, you have the alternative of detailing them on your policy as an "excluded motorist"this lets the cars and truck insurer understand about qualified motorists on your plan that you 'd such as to leave out for coverage (simply make certain they don't obtain your cars and truck) – vehicle insurance.

Be truthful when getting your car insurance policy quotes. Falling short to list a vehicle driver that you need to have disclosed could invalidate your coverage if they're in a mishap while driving your auto. That's ineffective. Discover more regarding who's covered on your car insurance coverage. Before we go Lemonade Vehicle is right here to aid you reduce your car insurance prices today, tomorrow, and as lengthy as you drive with us in the traveler's seat (as well as we guarantee never ever to ask you to change the radio terminal).

Multiple Autos and/or Vehicle Drivers May Conserve Money Whenever you go to your favorite supermarket, you'll usually get a better offer buying multiple loaves of bread in contrast to just one. The same reasoning relates to cars and truck insurance coverage. Generally, you'll finish up with a higher quote to guarantee a single lorry rather than guaranteeing several cars and/or motorists. insured car.

See This Report about 7 Ways To Lower Your Auto Insurance Rates – Ama – Alberta …

cheapest car cheapest car insurance car insurance car insured

cheapest car cheapest car insurance car insurance car insuredWhether you get into a fender bender or serious vehicle accident, accidents have a direct effect on your car insurance rate., as well as your premiums will likely boost.

Right here are some points you can do to maintain yourself as well as other motorists around you safe: Avoid texting and driving. Ensure to put on the "Do Not Disturb" attribute whenever you're driving. credit score. Do not consume while driving. Follow web traffic legislations and speed limitations. Do not drive under the influence of drugs or alcohol.

When you enroll in insurance policy, the business will generally ask the amount of miles you drive per year. This is one way an insurer estimates and establishes your premiums (cheapest car). Reducing your driving not just helps in reducing your automobile insurance policy but likewise your carbon footprint. According to the Facility for Climate and also Energy Solutions, changing to mass transit might decrease your carbon impact by 4,800 pounds each year.

cheap car affordable cheapest car

cheap car affordable cheapest carChoose Cars And Truck Security and Protection Includes Choosing particular auto security and security attributes can be a fantastic method to lower your car insurance policy rate. Many newer version autos will have the most recent safety and also security attributes already set up.

3 Easy Facts About Your Guide To Car Insurance Discounts – Credit Karma Explained

insurance companies money affordable car insurance prices

insurance companies money affordable car insurance prices7. Take a Defensive Driving Program Lots of people only take a protective driving program to disregard a ticket, however some insurer use discount rates anywhere from 5% to 20% if you finish a protective driving course by yourself accord – business insurance. Nonetheless, not every vehicle driver certifies for this kind of discount.

business insurance auto cheaper car car

business insurance auto cheaper car carSome states don't also enable these discounts at all. Be certain to chat to an insurance coverage agent prior to authorizing up for a defensive driving training course and also see if you're eligible for the price cut.

If you 'd like to get an on the internet quote or consult with a representative, Mercury Insurance coverage can assist you choose the insurance coverage that fits your spending plan and also way of life. perks.

According to, the typical person gets into an automobile accident every 17. Determining who in fact had the right of way or who is at fault can be fairly difficult to establish in some situations, which leads to the selection of an insurance coverage agent who is put on the case to represent you and help establish who is liable for repayments.

Some Known Factual Statements About 10 Important Safety Features That Lower Car Insurance

Automobile insurance policy is one of the most significant regular monthly expenses an individual have to pay. It can be determined that the national standard for an auto insurance coverage costs is around $1,500.

Up Front as well as Digital Repayments A lot of auto insurance firms charge rate of interest fees for insurance policy paid on a monthly basis – vehicle insurance. Some vehicle insurance firms will certainly provide price cuts for on-line repayments due to the fact that it is more practical as well as cost-saving for them.

5. Lifestyle Discounts Certain way of life variables such as driving habits, career, and educational accomplishments all have an impact on an insurance policy costs (insurance companies). Put simply, those who drive even more miles have to pay more for insurance policy, so if you have a career modification that requires less driving, you ought to report it to your insurance provider to see if you can obtain a discount rate.

On the other hand, "low-risk" line of work like scientists, pilots, and also accounting professionals will certainly have reduced rates since the nature of their jobs is to be extremely detail-oriented, and also their job days are extra structured and also stable. Education and learning additionally comes right into play when figuring out rates https://objectstorage.us-sanjose-1.oraclecloud.com with pupils. Several suppliers provide a "excellent pupil discount" which permits senior high school and also university trainees to gain as much as a 15% price cut on their automobile insurance policy premiums for keeping a "B" average – insurance.

Everything about Oci Tips For Saving On Auto Insurance

The driver's education training course price cut needs that a chauffeur be under the age of 21, and also the course has to be one that qualifies. The price cut obtained for qualified vehicle driver's education programs depends on whether your plan is high or reduced expense.

The protective driving training course discount rate can save you approximately 10% on an insurance policy costs (insurance company). Evidence of conclusion in both of these programs for their corresponding age require to be kipped down to your insurance coverage supplier in order to get the price cut.

Lower vehicle insurance. Most of us desire it, yet what is the best method to get lower, less expensive vehicle insurance coverage rates? Whether you're a seasoned driver, a new driver, have a bad driving background or have been in a mishap, or perhaps have a best driving record, look no more! We've got some valuable pointers on exactly how to get low car insurance.

We'll look at which aspects vehicle insurance provider make use of to compute car insurance policy costs and also share some discount rate offerings to help you maintain driving with the less expensive cars and truck insurance you desire! Just How to Get Lower Cars And Truck Insurance Policy Wondering exactly how to obtain your auto insurance coverage reduced? Right here are eight of the ideal means to maintain your insurance coverage prices low: Establish the automobile insurance coverage you actually require – cheap car.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.